French payroll tax calculator

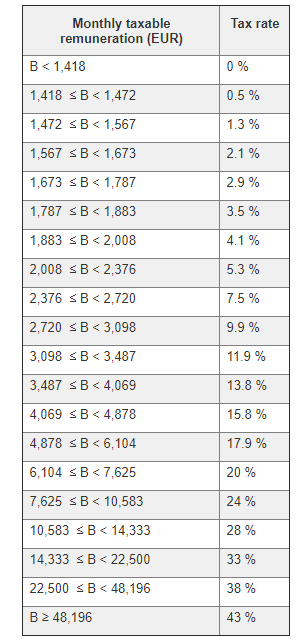

The current system of income tax collection is replaced by a withholding tax PAS prélèvement à. The tax rate is on a progressive sliced basis on the salary starting at 425 increasing to 1360 on that part of the salary above circa 15K However a rebate is then applied to the amount.

![]()

France Salary Calculator 2022 With Income Tax Brackets Investomatica

Income Tax in France From January 2019 personal income taxes are withheld on payslips.

. 0 to 10225 0 11 10226 to 26070 8424 at 11 926 This sum is then multiplied by 3. FR Income Tax Calculator Income After Tax Breakdown FR 20000 after tax is 16981 annually based on 2022 tax year calculation. Calculate and debit the withholding tax from your employees wages and pay it over to the French government.

Simply enter the advertised salary in the gross salary box. Rates are progressive from 0 to 45 plus a surtax of 3 on the portion of income that exceeds 250000 euros EUR for a single person and EUR 500000 for a married couple. Taxes for payroll in France Corporate tax The standard corporate income tax rate in France varies based on revenue.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. 20000 after tax breaks down into 1415. Youll then get a breakdown of your total tax liability and take.

Shield GEO becomes the Employer. Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20 for French-sourced income up to 27519 and 30 for income above this. The benefit in kind is a yearly.

Payroll contributions and personal income tax rates have been updated. It is charged at a rate of 97 on 9825 of gross salary if it does not exceed EUR164544 2020 ceiling per year and on 100 of the portion of the gross salary that exceeds EUR164544. Individuals with annual incomes between 250000 and 500000 must pay an additional 3 income tax while individuals with incomes in excess of 500000 must pay an additional 4.

The National Minimum Wage in France is now 1603 EUR gross or 1269 EUR net per month. The calculation of tax on 18650 using the rates and bands that apply for 2021 is. For fiscal year 2021 the standard tax rate is 265 for companies with.

France Salary Tax Calculator 2022 - Access Financial France Salary Tax Calculator 2022 Fill in the relevant information in the France salary calculator below and we will prepare a free salary. Generally 42 is the number you should keep in mind. The simulation can be refined by answering different questions.

Shield GEO manages all aspects of payroll for workers in France including taxes withholding social security payments and other statutory requirements. You can use our simulator to convert the gross salary into net salary. If the employer pays the fuel for personal usage of the vehicle the benefit in kin is then of 40 of the global cost of the lease all tax included.

The maximum an employee will pay in 2022 is 911400. Depending on how high the salary is the employers contributions will be between 15 and 42 of the gross salary. 7 rows France - Individual - Sample personal income tax calculation France Individual - Sample personal income tax calculation Last reviewed - 14 February 2022 Example.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. The withholding tax is thus debited from your account.

French Income Tax How It S Calculated Cabinet Roche Cie

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

Tax Rates In Europe Wikiwand

How To Calculate Foreigner S Income Tax In China China Admissions

Net Salary Calculator In French Sondrassong Org

Payroll Taxes France My Payroll Pro France

French Payroll With Social Contributions And Income Tax Deduction Along With A Calculator A Pen And Euro Coins Stock Photo Alamy

French Income Tax How It S Calculated Cabinet Roche Cie

How Income Tax Is Calculated In France Maupard

Payslip In France How Does It Work Blog Parakar

Close Up Pay Slip Calculator Photos Free Royalty Free Stock Photos From Dreamstime

Weekly Tax Calculator Sale Online 60 Off Www Ipecal Edu Mx

French Payroll With Social Contributions And Income Tax Deduction Along With A Calculator A Pen And Euro Coins Stock Photo Alamy

Taxation Of Rental Income In France Fbw

Close Up Pay Slip Calculator Photos Free Royalty Free Stock Photos From Dreamstime

How To Calculate Income Tax On Salary With Example

France Salary Calculator 2022 23